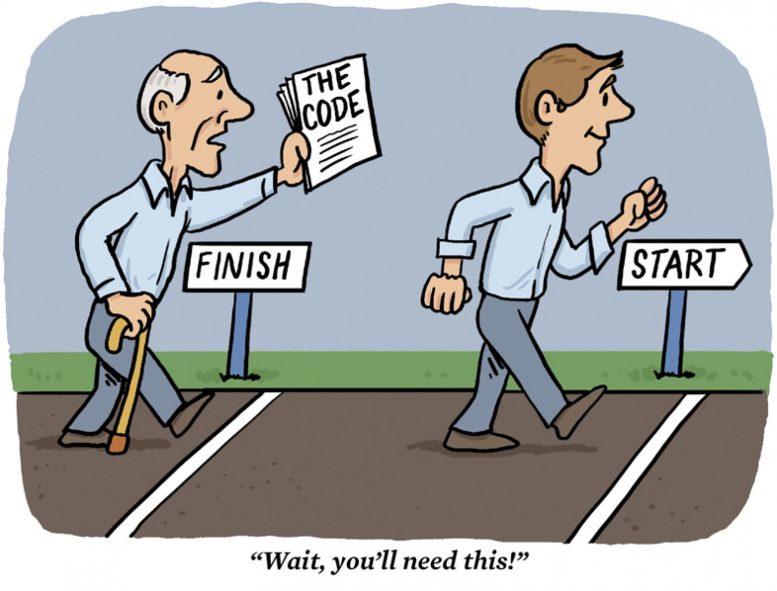

You’ve been dreaming about this since you were a kid, and now it has happened. You just got hired as a junior actuary. You’re so excited about starting off your career. You know about the exams; you also know about the type of work that you will be doing. You’ve got your promotions all scheduled out as well. Manager after five years, vice president or partner after another five years, and maybe president of the company later on. So exciting.

And you’ve just learned that there is something else—a Code of Professional Conduct (“Code”).

What is this Code? There is no distinction between actuaries working for a life insurance company, a health insurance company, a property and casualty insurance company or a pension consulting firm. But it looks simple enough—it’s just four pages. Fairly straightforward.

The Early Years

You’re spending most of your time learning technical skills and how to work with other actuaries and clients. You’re also taking actuarial exams that further provide you with technical tools. Naturally, you focus on these aspects of the trade.

But what about the Code—what is this and why is it important? Again, it’s only four pages.

Credentialed actuaries are required to perform their work in a professional manner—they are subject to the Code throughout their entire career. The Code covers professionalism. There are also qualification standards, which provide minimum requirements for actuaries to be qualified to do a specific type of actuarial work. And there are actuarial standards of practice (“ASOPs”) that provide actuaries with an analytical framework—what actuaries should consider, document, and disclose when performing an actuarial assignment. Adherence to all these standards enables the actuarial profession to be largely self-regulated; this is particularly important where significant government oversight might have undesirable results.

OK, a lot more reading. I guess it’s not that simple.

Developing professionalism starts early in your career. There are numerous seminars and training sessions on the Code and the ASOPs, as well as conferences or webcasts that you can attend. This is time well spent. You can learn what you can and cannot do, develop good habits, and avoid bad habits. Some of these misdeeds can have an adverse impact on your career.

You go bar-hopping and are involved in an auto accident. The information about the accident, your name and your employer’s name are published in a local newspaper—is this a problem? (Professional Integrity—Precept 1)

You work under the direction of a senior actuary. You can see how they handle professionalism. Most of the time, you have limited knowledge of all aspects of a client situation. You might not know how your employer is being paid, particularly if some of the payment is from commissions. Or, you might not be sure whether there are conflicts of interest or breaches of confidentiality. But you can ask. And you can readily determine if formal reports are effectively communicated. Do the reports identify the client, the purpose of the report, and the sources of data? Are they signed?

You tell your non-actuary friends that a certain public figure is a client—is this a problem? (Confidentiality—Precept 9)

Several years have passed. You’re thinking about changing jobs. This is not uncommon. You want to look good to a prospective employer, so you decide to “embellish” your resume.

You tell a prospective employer that you are an FSA when the results have not been finalized—is this a problem? (Professional Integrity—Precept 12)

The Middle Years

Ten years have passed. You now have a more significant role in your firm. You provide final technical and consulting results to clients or play a more senior role in developing these results.

One of your responsibilities is to ensure compliance with professionalism standards. Peer review can ensure that reports and actuarial work conform to standards—the report is signed, the client and data sources are identified, and the technical work is correct.

You issue a report that describes some but not all material assumptions or sources of data—is this a problem? (Standards of Practice—Precept 3, and Communications/Disclosure—Precept 4)

You also must ensure that there are no breaches of confidentiality, no conflicts of interest, proper disclosure of firm revenue, etc. In your current role, you often have direct knowledge of these issues.

You’re aware that your firm is also providing actuarial services to a competitor of your client—is this a problem? What do you do about it? (Conflict of Interest—Precept 7)

Sometimes, the current results are unfavorable to the client or they are expected to deteriorate in the near future. Are you informing the client … or hiding it? Is there a balancing act between keeping the client happy (and keeping your boss happy) or providing bad news to the client where appropriate?

You now have junior actuaries working for you; in addition to technical training, you can involve them in identifying possible Code issues that apply, discuss alternative methods of compliance, and demonstrate the thought process in arriving at the proper conclusion. They look to you for guidance. This not only ensures that the Code requirements have been met but provides valuable training to junior actuaries.

You may also be involved in marketing.

You’re trying to land a new client. To impress them, you tell a prospective client the names of your largest clients without their permission—is this a problem? (Confidentiality—Precept 9)

Late in Your Career

Another 20 years have passed—you are now a senior actuary. Or you may have established your own company. In either case, you not only provide high-level consulting services to your clients, but you can ensure that professional standards are followed. You are looked upon to set an example.

Yet, problems can occur.

Your firm receives commissions from a referral source that are not disclosed to your client—is this a problem? (Disclosure of Compensation—Precept 6)

In your work with other actuaries, you sometimes see problems with their work.

Work done under the direction of the actuary is incorrect, and it is not corrected—is this a problem? (Standards of Practice—Precept 3)

You lose a client to another consulting firm. It happens.

You don’t provide requested information to the new actuarial firm hired by your client—is this a problem? (Courtesy and Cooperation—Precept 10)

Retirement

You’ve just announced your retirement; it has been a rewarding career. It has involved not only technical work, but also consulting with clients and sometimes with regulators. And not surprisingly, there were tricky professionalism issues that have arisen.

The examples shown might be fairly straightforward. However, in the heat of the moment, we can easily forget about what’s expected of us. And while the technical work is often black-and-white, staying on the right side of the professional standards is sometimes not as clear. But that’s what makes it interesting.

RICHARD KUTIKOFF, MAAA, FSA, is a member of the Actuarial Board for Counseling and Discipline.