Yogi Berra said, “It’s tough to make predictions, especially about the future,” yet that is the essence of an actuary’s work. The bases of an actuarial analysis are the assumptions and the values selected for these assumptions. All actuaries realize that any assumption made about the future could ultimately prove to be incorrect. However, it is not possible to proceed without assumptions about the processes that drive the analysis.

Put simply: The actuary either should state that they are responsible for the assumptions in the analysis or should disclose the source of the assumptions and whether or not they are reasonable. (Note: This article focuses on Actuarial Standards of Practice [ASOPs] No. 41 and No. 43; other ASOPs provide more context and guidance for this important topic.)

ASOP No. 43, Property/Casualty Unpaid Claim Estimates, section 3.6.2 states, “Assumptions generally involve significant professional judgment as to the appropriateness of the methods and models used and the parameters underlying the application of such methods and models.” ASOP No. 41, Actuarial Communications, in section 3.4.4 discusses the actuary’s responsibility regarding the selection of assumptions and methods. To select assumptions, the first step is to identify the assumptions needed for a particular assignment. This may consist of information with respect to the same company and product, the same company but a different although similar product, a similar product sold by other companies, and sources unrelated to the company or product. It may be possible to combine data from different sources.

Values need to be assigned to the various assumptions. For example, if you are working on a property/casualty rate filing, you may need to assign value to trend loss development and the profit margin. Good starting points for these values can be best estimates, which are derived from available and appropriate information and appropriate actuarial techniques. In other cases such as pension measurements, assumptions are expected to be best estimate, at least from an accounting perspective. ASOP No. 43, section 3.6.2 states, “The actuary should use assumptions that, in the actuary’s professional judgment, have no known significant bias to underestimation or overestimation of the identified intended measure and are not internally inconsistent.” The values of certain assumptions may be prescribed by statute or by others. While the statutorily prescribed assumptions may be required, the actuary maintains the responsibility for assessing those assumptions prescribed by others.

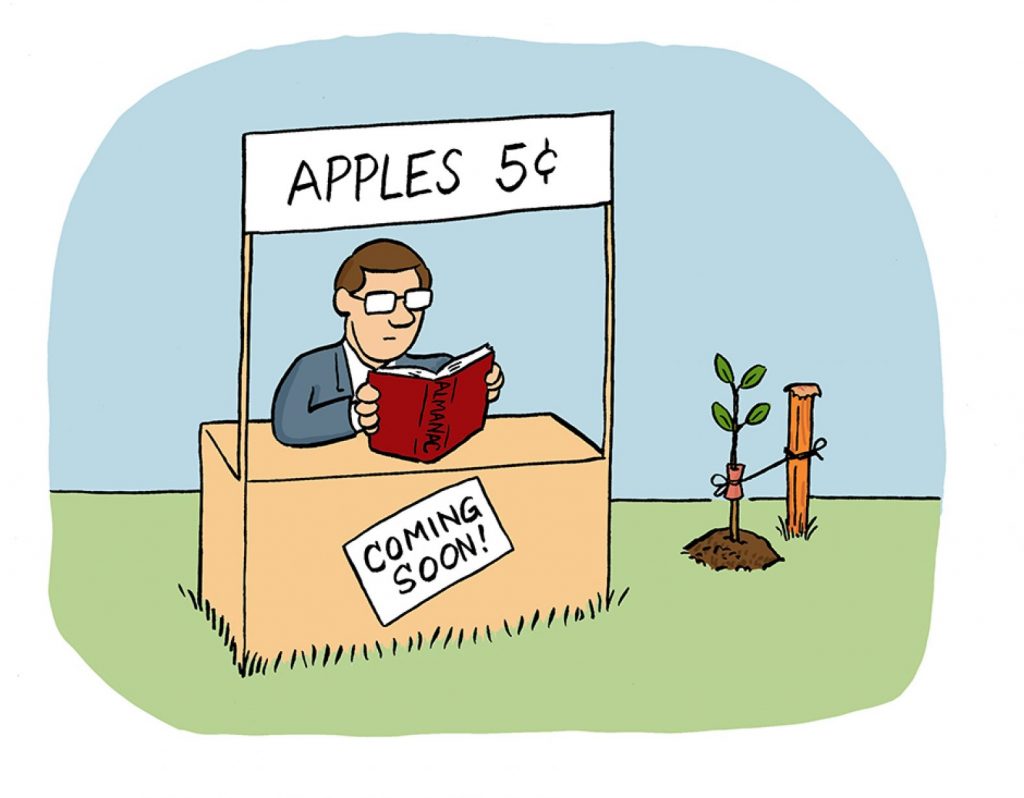

It is often difficult to know whether changes in past experiences are caused by underlying trends, random fluctuations, or cyclical influences. Therefore, emerging trends are often only reflected in the value of an assumption once they have been clearly established. Many actuaries would choose not to change the expected assumption value for small movements in recent experience. This is balanced with the desire to reflect the impact of many small changes when it is indicated that the current assumption values are no longer appropriate. ASOP No. 43, section 3.6.7, states, “When determining whether there have been known, significant changes in conditions, the actuary should consider obtaining supporting information from the principal or the principal’s duly authorized representative and may rely upon their representations unless, in the actuary’s professional judgment, they appear to be unreasonable.”

Actuaries are often faced with the challenge as to how much consideration to give management’s prescribed assertions with respect to assumption values. Under ASOP No. 41, section 3.4.4, if another party is responsible for the assumption or method and this does not conflict with the actuary’s judgment, then there is no obligation to disclose whether they think the assumption is reasonable, as it is implied that they do. However, if the assumption or method significantly conflicts with the actuary’s judgment, the actuary must include a statement to that effect. If the actuary is not able to judge the reasonableness of the assumption or method, the actuary must state that. For any assumption for which there is credible evidence that the risk is cyclical in nature, the best estimate assumption value can be projected to change in future years consistent with the expected cyclical behavior. Stress testing the impact of revised assumption values is helpful in determining what assumption values you ultimately want to use in your analysis.

The selection of assumptions could be fairly straightforward, especially if you are working on a project that you have experience with and the underlying environment is fairly stable. The bigger question arises when the underlying environment is not stable. How do you evaluate the impact of the introduction of a credit rating plan, a revised class plan, or the implementation of new legislation? Class plans are used by property/casualty insurers to divide a heterogeneous body of insureds into more homogeneous groupings in order to assign appropriate rates to each grouping. Some steps you can take are to use applicable industry data that could give you a handle on what the impact may be. In your analysis, you would document your data sources, as well as your reasoning for your selections. You might perform some stress testing of your results.

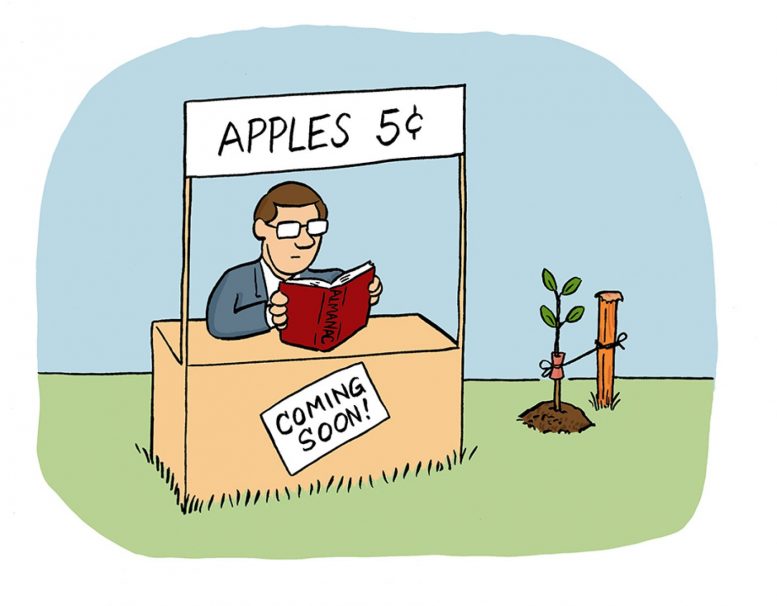

However, how would you handle a situation where there has been a change in the underlying environment, such as a class plan change, and management has indicated that this change will lower the expected loss ratios by 20%? A change in class plan could be the identification of a group whose experience is much worse than average. If an underwriting decision is made not to write any more business in that particular group and not to renew anyone who is currently in the group, this could have a positive impact on the overall experience. But suppose management has not provided you with any support for this value. How should you proceed with your annual reserve analysis? Because you are familiar with this company and the product, you could check the historical results to see what loss ratios have been achieved in the past, and whether there has ever been a point in time when the company was able to produce the level of loss ratio it is predicting for the future. If the company has produced such low loss ratios in the past, you might want to consider including that in your analysis.

If, however, you could not find any support for these low ratios, how can you proceed? You might be able to glean some information from the industry to see how it has performed for this line of business. It is important to make adjustments that take into account the specific states the company is writing in and which states compose the industry information. If you can, you should consider trying to adjust for other differences such as policy provisions or exposure profile. You can use this information as a benchmark for your analysis.

You might have to perform your analysis using a number of different scenarios. You might start your analysis using management’s loss ratio assumption and the methods that you usually apply, and then calculate what the reserve would look like under that scenario. You could also produce another scenario using the actual loss ratios that have been realized in the past and develop a loss reserve. This would allow you to produce a range around that result, and to determine whether the results based on management’s judgment fall within that range.

Your next steps will reflect the outcome of this test. You might consider trying methodologies that are not as dependent on the loss ratio and see how those results compare to the other scenarios. If management’s results fall nicely within the range of your results, you might feel comfortable saying that management’s estimates are reasonable. You should include a narrative describing the assumptions and methods that were used. If the results are at the low end of your reasonable range or if management’s estimate is not within your range, consider having a discussion with management to discuss your results. If management insists that their assumptions must be used, you must document the results of all your scenarios and include any risks of material adverse deviation of which you are aware.

As the actuary you are responsible for the assumptions, methods, and results of the analysis, unless those assumptions are prescribed in particular circumstances. While management might have a rosy picture of what the future will look like given the decision to eliminate what appears to be those insureds with poorer experience, you as the actuary are responsible for the assumptions, methods, values, and analysis. Relying on the projections of management without the necessary support is not enough for the results of your analysis. It is important to keep the lines of communications open between the actuary and management to discuss and work through any differences.

As stated by J.M. Pemberton in his paper The Methodology of Actuarial Science (1998), “Actuarial science is concerned with the development of models which approximate the behaviour of reality and have a degree of predictive power, not the truth.” It is your responsibility as the actuary to decide what assumptions, values, and methods are reasonable and provide support for your position. You might not end up being right, but you will have fulfilled the conditions necessary to make appropriate predictions about the future.

DEBORAH M. ROSENBERG, MAAA, FCAS, is a member of the Actuarial Board for Counseling and Discipline.