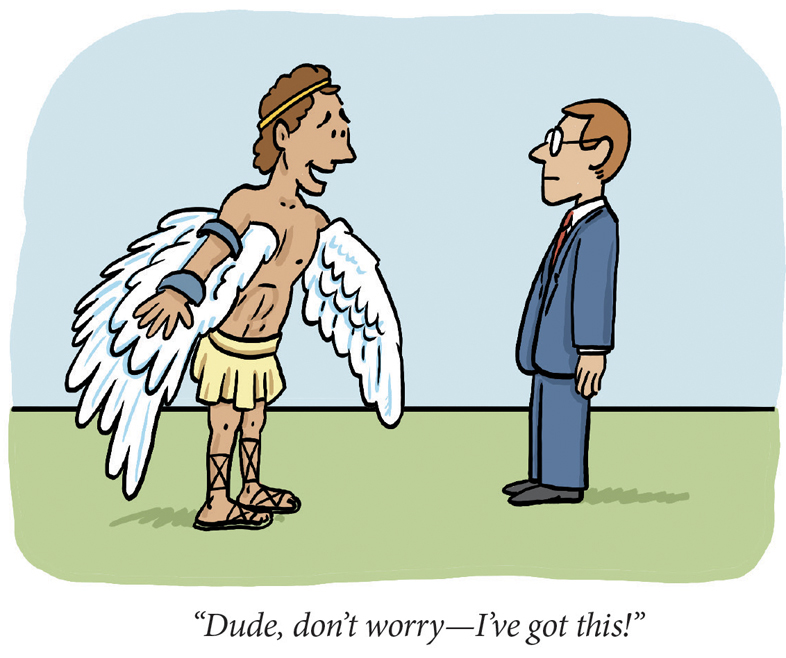

No, this article does not describe how Actuarial Standards of Practice are handed down from Mount Olympus, nor how the Actuarial Board of Counseling and Discipline (ABCD) adjudicated the famous Sisyphus complaint!

Instead, based upon issues that the ABCD have regularly encountered, I have chosen to highlight three “myths” that are commonly (and erroneously!) associated with actuarial professionalism.

Myth #1: “I am held to the Code only when I am providing actuarial services.”

The Code of Professional Conduct adopted by the five U.S.-based actuarial organizations has as its very first Precept:

Professional Integrity

PRECEPT 1. An Actuary shall act honestly, with integrity and competence, and in a manner to fulfill the profession’s responsibility to the public and to uphold the reputation of the actuarial profession.

Particularly relevant to this discussion is the associated comment (emphasis added):

ANNOTATION 1-4. An Actuary shall not engage in any professional conduct involving dishonesty, fraud, deceit, or misrepresentation or commit any act that reflects adversely on the actuarial profession.

It is also interesting to note that the Actuaries’ Code of the Institute and Faculty of Actuaries in the U.K. contains the following:

Scope: The Code applies at all times to all Members’ conduct in relation to an actuarial role.

The Code also applies to all Members’ other conduct if that conduct could reasonably be considered to reflect upon the profession.

The latter comment is further discussed in their Guidance to the Code: “This means that conduct outside of a Member’s actuarial professional life that demonstrates a lack of respect towards others will be caught by the Code, but only to the extent that it may have an impact upon the reputation of the actuarial profession as a whole.”

From the other side of the globe, the Explanatory Memorandum to Code of Conduct (March 2020) of the Actuaries Institute of Australia includes the comment: “The Code covers all conduct that might reflect poorly on the profession and not just professional conduct.”

All these comments emphasize the fact that every actuary has the very important responsibility to act in a manner that reinforces the confidence that the public has in our profession. This is in addition to the need to conform to all appropriate technical standards, and all the precepts of the Code, when providing actuarial services.

We must all realize that the trust that the public has in the professionalism of all actuaries can easily be undermined by the poor behavior of any one actuary. Obviously, broad public awareness of criminal activities such as insider trading, fraud, or sexual assault committed by actuaries clearly has a detrimental effect on the public’s perception of the quality of people representing our profession. But criminal behavior is not the benchmark. Disrespectful treatment of clients, colleagues, and members of the general public, while not rising to the level of criminal or civil offenses, can easily give the impression that our profession tolerates inappropriate behavior from our members, whether that behavior is of a professional or personal nature.

Myth #2: “The only time I need to be worried about meeting Qualification Standards is when I issue NAIC opinions.”

Precept 2 of the Code of Professional Conduct states: “An Actuary shall perform Actuarial Services only when the Actuary is qualified to do so on the basis of basic and continuing education and experience, and only when the Actuary satisfies applicable qualification standards.” The relevant document for services rendered in the in the U.S. would ordinarily be Qualification Standards for Actuaries Issuing Statements of Actuarial Opinion in the United States (USQS).

In the 2008 revision, the USQS introduced the following language:

a “Statement of Actuarial Opinion” (SAO) is an opinion expressed by an actuary who is subject to the Code of Professional Conduct by virtue of membership in a U.S.-based actuarial organization, where such opinion is expressed in the course of performing Actuarial Services and intended by that actuary to be relied upon by the person or organization to which the opinion is addressed. “Actuarial Services” are defined in the Code of Professional Conduct as ‘Professional services provided to a Principal [client or employer] by an individual acting in the capacity of an actuary. Such services include the rendering of advice, recommendations, findings, or opinions based upon actuarial considerations.”

It is worth noting that this wording is unchanged in the recent 2022 revision of the USQS.

A careful reading of these references clearly leads one to realize that, in any given year, most actuaries provide clients, colleagues, and employers with hundreds of “statements of actuarial opinion.” An internal team discussion of a corporate ERM model, a hallway conversation with your CEO and CFO as they are entering a board meeting, and a presentation on reserving to a regional actuarial club are just a few of the many possible opportunities for an actuary to issue an SAO.

Of course, NAIC Annual Statement opinions are also SAOs and are subject to additional requirements in the USQS. These requirements are described in Section 3—Specific Qualification Standards. However, these are a very small subset of the types of opinions actuaries regularly provide and it is important to have a complete understanding of how all SAOs are addressed by the Code and the Qualification Standards.

Myth #3: “The ABCD has the final say on disciplining actuaries.”

In 1992, the American Academy of Actuaries (Academy), the American Society of Pension Professionals and Actuaries (ASPPA), the Casualty Actuarial Society (CAS), the Conference of Consulting Actuaries (CCA), and the Society of Actuaries (SOA) established the Actuarial Board for Counseling and Discipline (ABCD) and delegated to the ABCD the power to investigate and evaluate possible violations of their Code.

As the Academy website states:

The ABCD within its jurisdiction has authority to:

1. Consider all complaints concerning alleged violations or information suggesting possible violations of the applicable Code(s) of Professional Conduct. The Codes, in turn, incorporate by reference applicable qualification standards and applicable standards of practice. The ABCD may also consider questions that arise as to the conduct of a member of a participating organization in the member’s relationship to that organization or its members, in the member’s professional practice, or otherwise affecting the interests of the actuarial profession. Although investigations of possible violations of the Code(s) will usually be initiated based on complaints, the ABCD may also initiate such investigations based on information available to it suggesting possible violations of the Code(s) of Professional Conduct;

2. Counsel actuaries concerning their activities relative to the Code(s) of Professional Conduct in situations where the ABCD deems counseling appropriate;

3. Recommend disciplinary action against an actuary to any participating organization of which the actuary is a member, recognizing that authority to discipline members rests exclusively in the participating organizations;

4. Respond to requests for guidance regarding professionalism from members of participating organizations and actuarial students affiliated with the participating organizations; and

5. Mediate or appoint a mediator to resolve issues concerning professional conduct between members of participating organizations, or between such members and the public.

It is important to realize that the ABCD was established to create an efficient mechanism to investigate possible violations of the Code of Professional Conduct and, if appropriate, recommend disciplinary action to be taken by the relevant organization.

The ABCD has no authority to directly discipline any actuary. It can only provide a report of its investigation and deliberations to the organization(s) of which the accused actuary is a member. Ultimately, any disciplinary action taken against an actuary would be the result of a determination made by the member’s organizations.

Conclusion

While the details of the application of the Code may, at times, be complex, it is obviously essential that each actuary take the time to understand its key provisions. Our profession has a proud history of service to the public, and we all must diligently protect that hard-earned reputation. That is a fact, not a myth!

Albert J. Beer, MAAA, FCAS, is a member of the Actuarial Board for Counseling and Discipline.