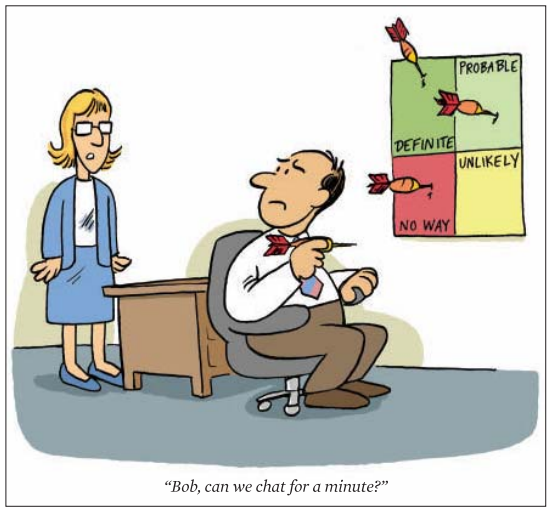

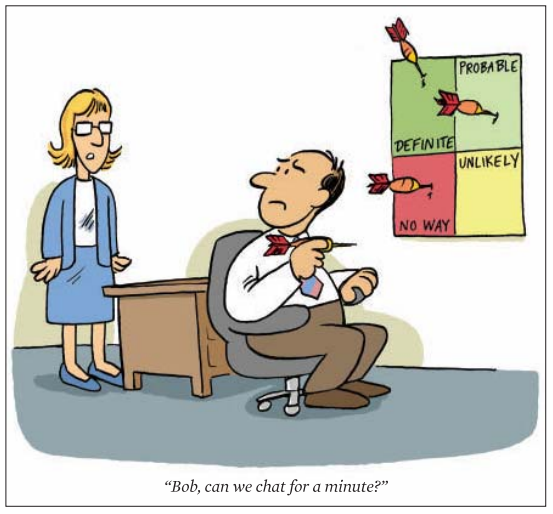

WHAT IS IT ABOUT the requirements of Precept 13 that makes many actuaries uncomfortable? One of 14 precepts in the Code of Professional Conduct, Precept 13 requires an actuary to take action if he or she has knowledge of a potential violation of the code by another credentialed actuary. Much like the Transportation Security Administration ads, this is the “if you see something, say something” requirement.

As I thought about why we are reluctant to deal with potential violations of the code among our peers, it occurred to me that maybe it’s part of our upbringing. As children, we were told to work things out when interacting with playmates and siblings. How many of us heard the parental admonition, “Don’t be such a tattletale”? As we got into high school and participated in activities such as athletics, we were encouraged to be part of the team. The culture there tended to frown on a team member who ratted out another. And, I believe, this culture carried on into college, where most undergraduates would turn a blind eye to all but the most egregious violations of campus rules by their peers.

Now that we are credentialed actuaries, however, we are part of a profession, and the rules and perceptions must change. Code violations by our members are serious business for all of us. It takes only a few publicized cases of bad work to ruin the reputation of the entire profession and undermine public trust in what we do. As a self-regulated profession, we have established:

- Rules for admission, including basic education and/or experience and continuing education;

- A Code of Professional Conduct;

- Qualification Standards and standards of practice;

- Rules addressing how and when members may be counseled, disciplined, or removed from professional membership.

Because the U.S. actuarial profession is self-regulated, compliance with Precept 13 is a critical element in ensuring that our members meet the standards we have established. And because actuaries understand better than those outside the profession what might constitute a violation of the code, self-reporting is the best vehicle for policing ourselves.

So what is it that Precept 13 requires us to do? Precept 13 says, “An Actuary with knowledge of an apparent, unresolved, material violation of the Code by another actuary should consider discussing the situation with the other actuary and attempt to resolve the apparent violation. If such discussion is not attempted or is not successful, the Actuary shall disclose such violation to the appropriate counseling and discipline body of the profession, except where disclosure would be contrary to Law or would divulge Confidential Information.”

Precept 13 also contains two annotations. The first deals with materiality and says in part, “A violation of the Code is deemed to be material if it is important or affects the outcome of a situation.” The second explains that an actuary is not expected to discuss the violation with the other actuary if either is prohibited by law from doing so or is acting in an adversarial environment involving the other.

Know Your Options

Understanding the importance of compliance with Precept 13 and actually handling a situation in which there has been an apparent violation of the code are very different. It can be awkward for all parties involved. Overcoming our ingrained aversion to turning others in is difficult. And many simply aren’t comfortable with that type of conflict.

From time to time, members of the Actuarial Board for Counseling and Discipline (ABCD) get requests for guidance from actuaries who are faced with possible Precept 13 situations. While each instance is unique, we find that many possible violations of the code can be resolved by speaking with the other actuary. That discussion might even lead to better understanding by both parties, especially when some aspect of professional judgment has been involved. In some instances, the discussion leads to clarification of the issue or application of the code or an actuarial standard of practice (ASOP), and the situation is resolved.

But what are your options if a discussion doesn’t take place? Note that Precept 13 doesn’t require you to talk with the other actuary. Annotation 13-2 says an actuary is not expected to discuss the potential violation if prohibited by law or if an adversarial relationship exists with the other actuary. You also can decide that you simply don’t want to have the conversation. Or perhaps you did talk with the other actuary and matters weren’t resolved to your satisfaction.

Overcoming our ingrained aversion to turning others in is difficult. And many simply aren’t comfortable with that type of conflict.

The reason doesn’t matter here, but Precept 13 clearly states that the actuary shall disclose the violation to the ABCD if the discussion didn’t occur or was unsuccessful. And, it should be noted, failure to comply with the requirements of Precept 13 could be a violation of Precept 1, which states “An Actuary shall act honestly, with integrity and competence, and in a manner to fulfill the profession’s responsibility to the public and to uphold the reputation of the actuarial profession:’ Fortunately, the Academy’s Council on Professionalism in December 2013 published a paper on dealing with Precept 13 issues, The Application of Precept 13 of the Code of Professional Conduct. The discussion paper doesn’t provide guidance like an ASOP but provides thought-provoking ideas from fellow actuaries on ways to comply with this difficult precept. The paper includes an infographic that depicts the Precept 13 process. The paper also offers examples and attempts to better describe the terms “apparent;’ “unresolved;’ and “material:’ Whether or not you are facing a Precept 13 situation, I would urge you to take the time to read this paper, which is available at actuary.org/files/Precept13.

While it may be difficult to apply in practice, Precept 13 is a cornerstone to the structure of the U.S. actuarial profession. We all need to be aware of its requirements. And, as always, if you want to discuss a Precept 13 situation in confidence, please reach out to a member of the ABCD. You can find us on the ABCD’s website, www.abcdboard.org/.

JOHN PURPLE, a fellow of the Casualty Actuarial Society, a member of the Academy, and a member of the Actuarial Board for Counseling and Discipline, is a part-time actuary with Risk & Regulatory Consulting LLC in Farmington, Conn. He is a former regulator with the Connecticut Insurance Department.

Download this article as a PDF